Bitcoin’s recent price surge of 2% within a 24-hour period has prompted speculation about its potential implications for investors.

As market dynamics continue to evolve, the question arises: Is this surge signaling an opportune moment to consider buying Bitcoin? Let’s find out.

Navigating the Future of Bitcoin Integration: Michael Saylor’s Insights

In a recent podcast interview, Michael Saylor, CEO of MicroStrategy, highlighted his perspective on the growing trend of large corporations embracing and centralizing Bitcoin.

Saylor emphasized the inevitability of third-party and corporate involvement in the Bitcoin ecosystem.

He conveyed that as Bitcoin becomes more integrated into society, various use cases will emerge, and a one-size-fits-all approach may not be applicable.

Saylor outlined three key reasons for the need of custodians in the Bitcoin space:

- Technical

- Political

- Natural

From a political standpoint, Saylor acknowledged that certain political structures might necessitate reliance on third-party custodians.

On the technical side, he recognized the role of layer 3 third parties like Bank of America and Apple in providing functionality for mobile crypto transactions.

Additionally, Saylor emphasized that for natural reasons, certain individuals, such as the elderly or those wanting to secure assets for future generations, might find it safer to entrust their holdings to others.

Saylor’s view is that Bitcoin will encompass various integration approaches, and the market will determine the optimal blend of custodial and self-sovereign methods.

He stressed that the multitude of integration approaches should not be feared, as the evolving Bitcoin landscape will naturally define the most suitable mix of integration methods.

Bitcoin Price

As of now, the current price of Bitcoin stands at $29,366, accompanied by a trading volume of $6.1 billion over the past 24 hours.

Holding the top position on CoinMarketCap, Bitcoin boasts a live market capitalization of $571 billion.

The circulating supply consists of 19,455,681 BTC coins, while the maximum supply is capped at 21,000,000 BTC coins.

Bitcoin Price Prediction

The support level for Bitcoin, near $29,200 remains steady, and its technical outlook has not changed.

Currently, BTC is trading with a neutral bias due to challenges in surpassing the $29,600 mark in the four-hour timeframe.

If there is a bullish breakout above the $29,600 level, BTC could potentially reach the $30,200 level.

The price of Bitcoin has hit a key retracement level of 61.8%, reaching $29,200.

Observing the closing of doji candles above this level suggests a possible bullish correction. However, if the price drops below this level, it may descend to $29,250.

Conversely, if BTC manages to overcome the resistance at $30,200, it could potentially push toward the range of $30,600 to $31,000.

It is important to note that the zones at $29,800 and $30,200 are crucial. Any potential shifts below these levels could indicate a bearish trajectory for BTC.

Top 15 Cryptocurrencies to Watch in 2023

If you want to keep up-to-date with the latest initial coin offering (ICO) projects and alternative cryptocurrencies, you should regularly check out our handpicked collection of the top 15 digital assets to watch in 2023.

This list has been carefully selected by industry experts from Industry Talk and Cryptonews, so you can trust their recommendations and insights.

By following this list, you can stay ahead of the game and explore the potential of these cryptocurrencies in the rapidly evolving world of digital assets.

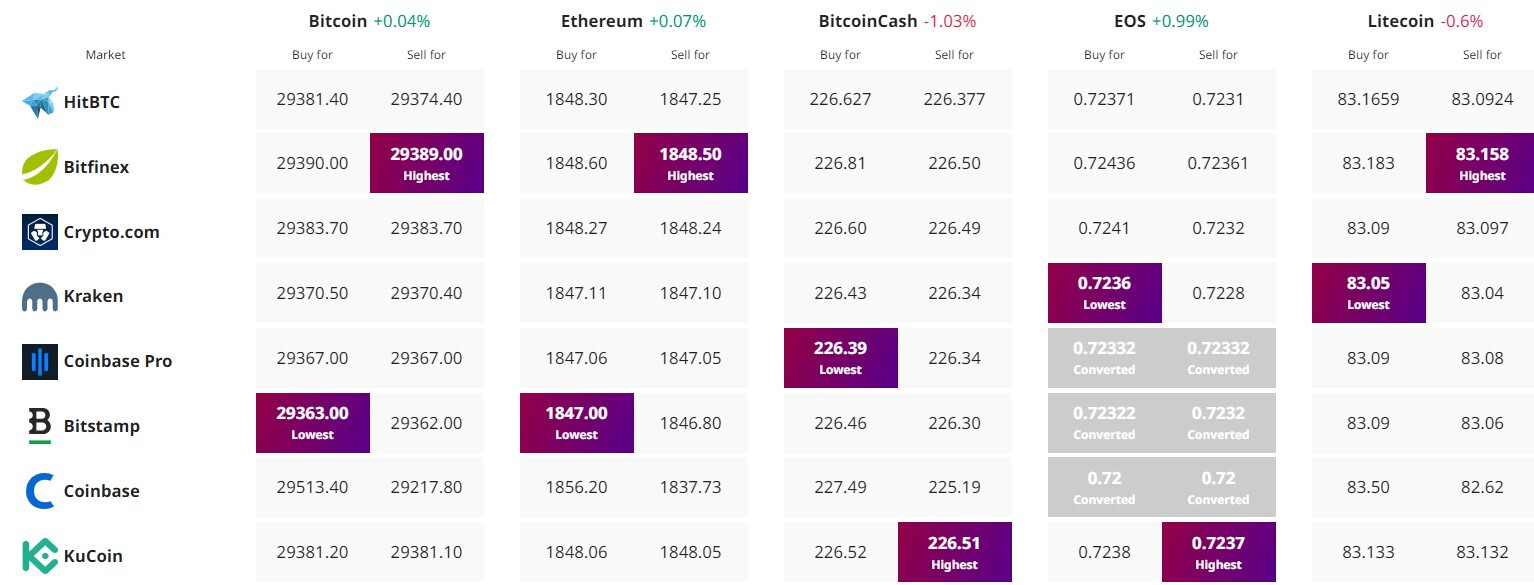

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/primexbt-markets-e1738588646201.jpg)

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/primexbt-markets.jpg)

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/PrimeXBT-Trading.jpg)