Amidst a dynamic landscape in the cryptocurrency realm, Bitcoin’s price has taken center stage.

Currently trading at $27,452, reflecting a notable 5.5% increase on Wednesday, Bitcoin’s trajectory continues to capture attention.

This analysis delves into the recent legal victory achieved by Grayscale in the Bitcoin ETF Conversion Lawsuit and the impressive second-quarter earnings report from Bitcoin miner Canaan.

These developments hold the potential to significantly influence Bitcoin’s future outlook and market sentiment.

Court Rules in Favor of Grayscale in Bitcoin ETF Conversion Lawsuit

Grayscale, the leading crypto asset manager, has secured a favorable ruling in its legal battle against the US Securities and Exchange Commission (SEC) over the conversion of its flagship bitcoin trust (GBTC) into a spot bitcoin exchange-traded fund (ETF).

The US Court of Appeals for the District of Columbia Circuit sided with Grayscale, asserting that the SEC’s denial of the conversion lacked proper justification and treated similar products differently.

The court emphasized the SEC’s failure to adequately justify differing decisions on Bitcoin-related products. This ruling is pivotal for two reasons. ETFs broaden crypto investment accessibility, potentially mobilizing dormant capital.

Additionally, it challenges the SEC’s dominance over crypto, highlighting the US court system and Congress as alternate interpreters.

This positive development in the bitcoin ETF scenario is what has given strength to the BTC/USD prices recently.

Canaan reports 33% increase in earnings for Q2

Bitcoin mining equipment manufacturer Canaan has reported a 33.7% increase in revenue for Q2, reaching $73.9 million.

The company’s mining revenue surged by 43.4% to $15.9 million, compared to $11.1 million in Q1 2023 and a significant 105.1% rise from the same period last year.

Although Canaan experienced a net loss of $110.7 million in the second quarter due to inventory write-down and other factors, their balance sheet showed a 115% increase in cryptocurrency assets with 747 Bitcoins owned.

Despite challenges such as reduced hash prices and increased mining difficulty in the industry, Canaan’s revenue growth is likely contributing to the current rise in BTC/USD prices.

Bitcoin Price Prediction

Upon conducting a daily technical analysis of Bitcoin, it becomes apparent that the cryptocurrency has successfully emerged from its previous phase of sideways consolidation.

This range, characterized by a lower boundary at $25,400 and an upper resistance near 26,800, has been surpassed by Bitcoin’s recent price movement.

Examination of key technical indicators, including the Moving Average (MA), Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI), all point towards a robust bullish trend currently prevailing in the market.

The bullish sentiment remains robust, underscored by the 50-day Exponential Moving Average (EMA) positioned around the $26,250 level.

Following the bullish breakout above $26,800, Bitcoin’s trajectory may potentially lead it toward the $28,600 mark.

As we delve further, let’s also delve into an exploration of the top 15 currencies to monitor in 2023.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

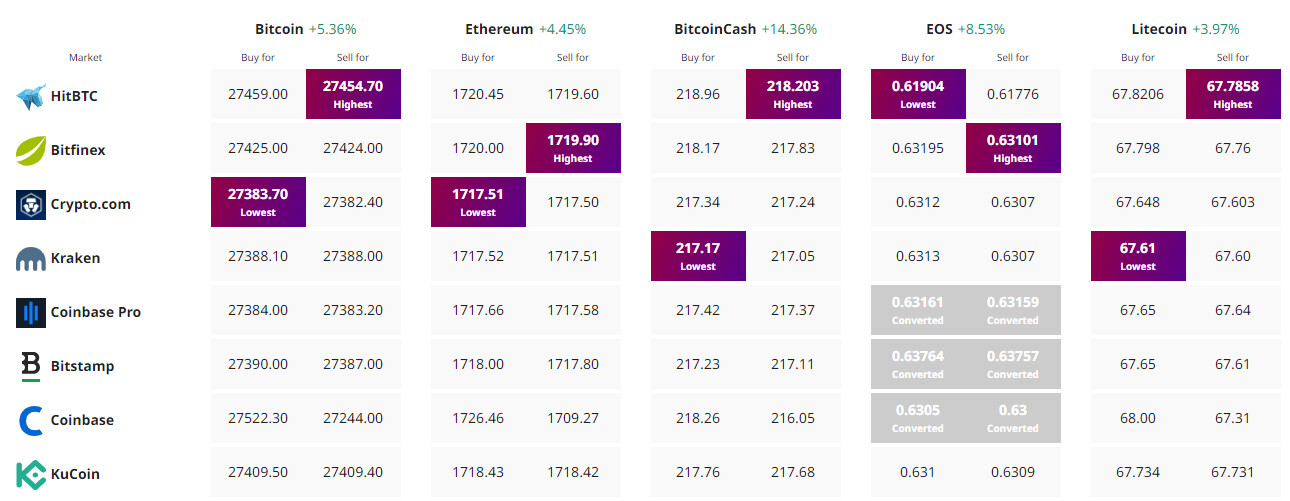

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/primexbt-markets-e1738588646201.jpg)

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/primexbt-markets.jpg)

![https://primexbt.investments/start_trading/?cxd=459_549985&pid=459&promo=[afp7]&type=IB](https://tradinghow.com/wp-content/uploads/2025/02/PrimeXBT-Trading.jpg)